After Tax Reform 2018 Which Business Entity Has Best Advantages

Most of the changes in the new law take effect in 2018 and will affect tax returns filed in 2019. As of January 1 2018 all corporations will pay a flat tax rate of 21.

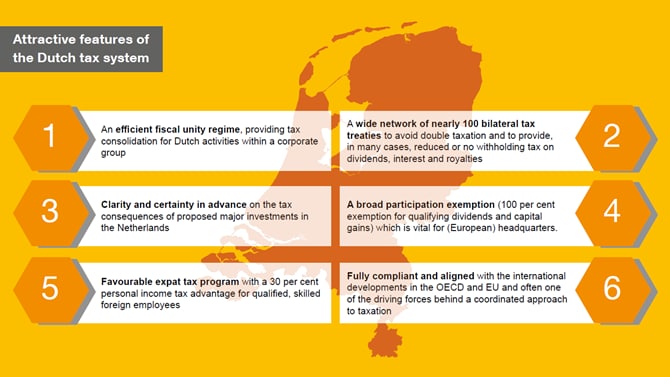

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

Every corporation is considered a C Corp when it is formed with the Secretary of State.

. The Highlights of Tax Reform for Businesses. Under prior law C corporations were taxed at rates as high as 35. The LLC is a better legal entity and because of its flexibility.

For tax years beginning in 2018 and beyond the Tax Cuts and Jobs Act TCJA created a flat 21 federal income tax rate for C corporations. Losses from C corporations cant be deducted by their owners. But the TCJA also benefits many small businesses while.

Easy to integrate business use of home deductions. Because corporate tax rates are lower companies that have retained earnings can take advantage of the lower rates. Cons No liability protection.

Thursday August 30 2018. The corporate tax rates are typically lower than personal income tax rates. Limited Liability Companies LLC The LLC like the S - Corporation provides for pass through taxation.

Limited Liability Companies LLC An LLC like the S Corporation provides for pass through taxation. Starting in 2018 some key deductions that businesses have relied on are either going away or getting stricter requirements. It has been 30 years since there has been a significant tax reform and the Tax Cuts and Jobs Bill that recently passed is certain to impact everyone -- from individual taxpayers to business owners.

An LLC is considered a disregarded entity and its tax treatment depends on the number of members. SOME BUSINESS DEDUCTIONS ARE GONE OR HARDER TO TAKE. Theres no easy answer to this question though the entity choice considerations have undergone some changes due to the new tax law.

If your small business is incorporated as a C corporation your business income tax rate will now be 21 percent. No double taxation of pro ts. Self-employment tax is assessed on entire pro t of the business.

Previously the top corporate income tax rate was 35. Now that the corporate income tax rate has been significantly reduced choice of entity decisions are a much closer call. Tax on corporate income and tax on dividends to shareholders have been somewhat mitigated.

For a fiscal year regular corporation with a tax year ending in 2018 the new 21 percent rate will be blended with the rates in place prior to January 1 2018. But the TCJA also benefits many small businesses while presenting new obstacles. Easy to operate and dissolve.

No separate tax return. Personal service corporations will also be subject to the 21 percent rate. You can no longer deduct entertainment expenses.

Taking Advantage of the New Tax Reform. With the new lower tax rate for C corporations many pass-through entities including S corporations are reconsidering their structure to take advantage of the. Jun 13 2018 by Jason B.

The distinction is made on a federal level and processed by the IRS. Business distributes all profits to owners. This fact sheet summarizes some of the changes for businesses and gives resources to help.

Tax Advantages of a C-Corporation. Ever since Congress enacted the Tax Cuts and Jobs Act in December many business owners are reconsidering which business entity makes the most sense for their particular business. The monumental new tax law signed late in 2017 the Tax Cuts and Jobs Act TCJA has been hailed as a boon for big business.

A new income tax rate for C corporations. For a business that consistently generates losses theres no tax advantage to operating as a C corporation. The largest benefit out of the entire reform bill needs a category all on its own.

Choice of Entity for a Startup Business after Tax Reform. A pass-through entity will generally make more sense because losses pass through to the owners personal tax returns. The act also repeals the corporate Alternative Minimum Tax for tax years beginning after December 31 2017.

One of the most immediate benefits business owners will notice with the new tax code is a decrease in the corporate tax rate from 35 percent to. In general the revised rules for businesses take effect in 2018 and are permanent unlike most. Acquiring small business funding for your enterprise needs has never been easier.

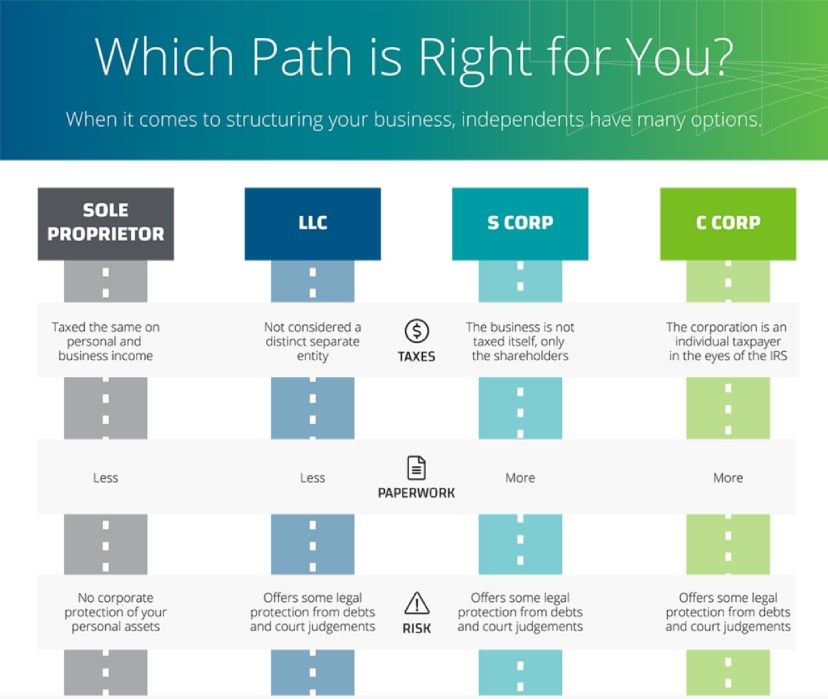

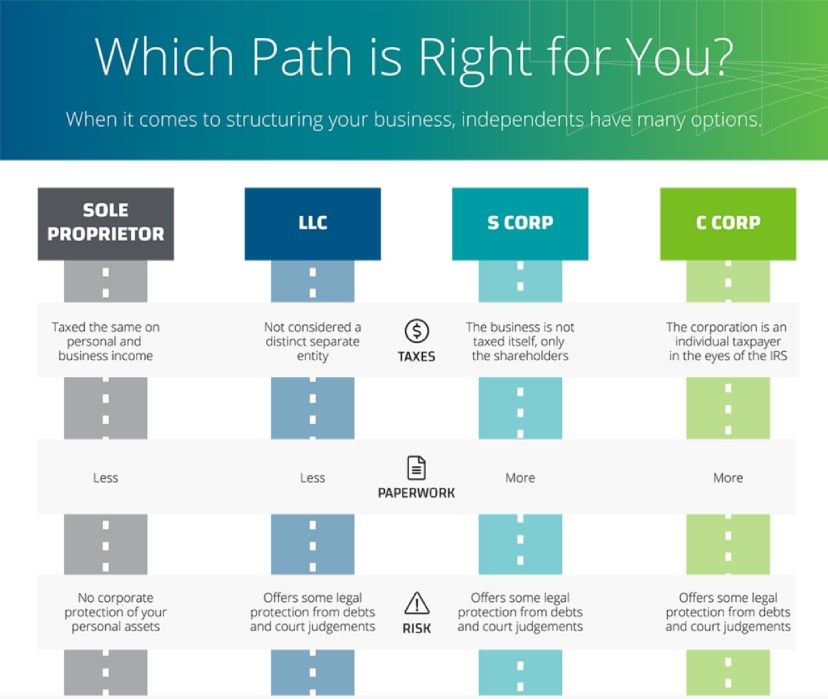

The benefit now lies within the hands of small business owners needing dependable and ethical financial assistance in order to grow. Business Entity Pros and Cons Sole Proprietorship Pros No formal creation process. Tax considerations and state-law principles affecting owner liability control and continuity play a role in the choice-of-entity analysis.

The Tax Cuts and Jobs Act included a few dozen tax law changes that affect businesses. Because corporate tax rates are lower companies that have retained earnings can take advantage of the lower rates. So its important to consult with your tax advisers before making any moves.

Choice of Entity After Tax Reform. Tax Pro Shows Hidden Benefits of 2018 Tax Reform Law. Which Entity Offers the Best Tax Advantages.

The choice of entity is a fundamental decision in structuring a trade or business. In some cases it may even be worth changing the type of business entity you have. Business generates tax losses.

This change may cause some business owners to revisit their choice of entity since the double taxation problems related to corporations ie. There are two main types of corporations the S Corporation and the C Corporation. The monumental new tax law signed late in 2017 the Tax Cuts and Jobs Act TCJA has been hailed as a boon for big business.

The Tax Cuts and. While Table 3 shows a range of 86 to 198 savings in tax rates for C corporations if an owner retains all after-tax cash forgoing dividends that savings today will be offset by additional cost tomorrow when the owner of a FTE can afford to pay dividends tax-free or when he or she sells the company and can take out all the undistributed earnings prior to. Prior to tax reform tax considerations tipped the scale heavily in favor of operating a business through a partnership or other pass-through entity rather than a corporation.

Previously the tax rate varied from 15 to 35 percent depending on the business taxable income for the year. When an entrepreneur makes the decision to form a legal entity for a new business the choice of legal entity.

How To Choose Your Llc Tax Status Truic

How To Choose The Best Legal Structure For My Business Mbo Partners

4 Types Of Business Structures And Their Tax Implications Netsuite

0 Response to "After Tax Reform 2018 Which Business Entity Has Best Advantages"

Post a Comment